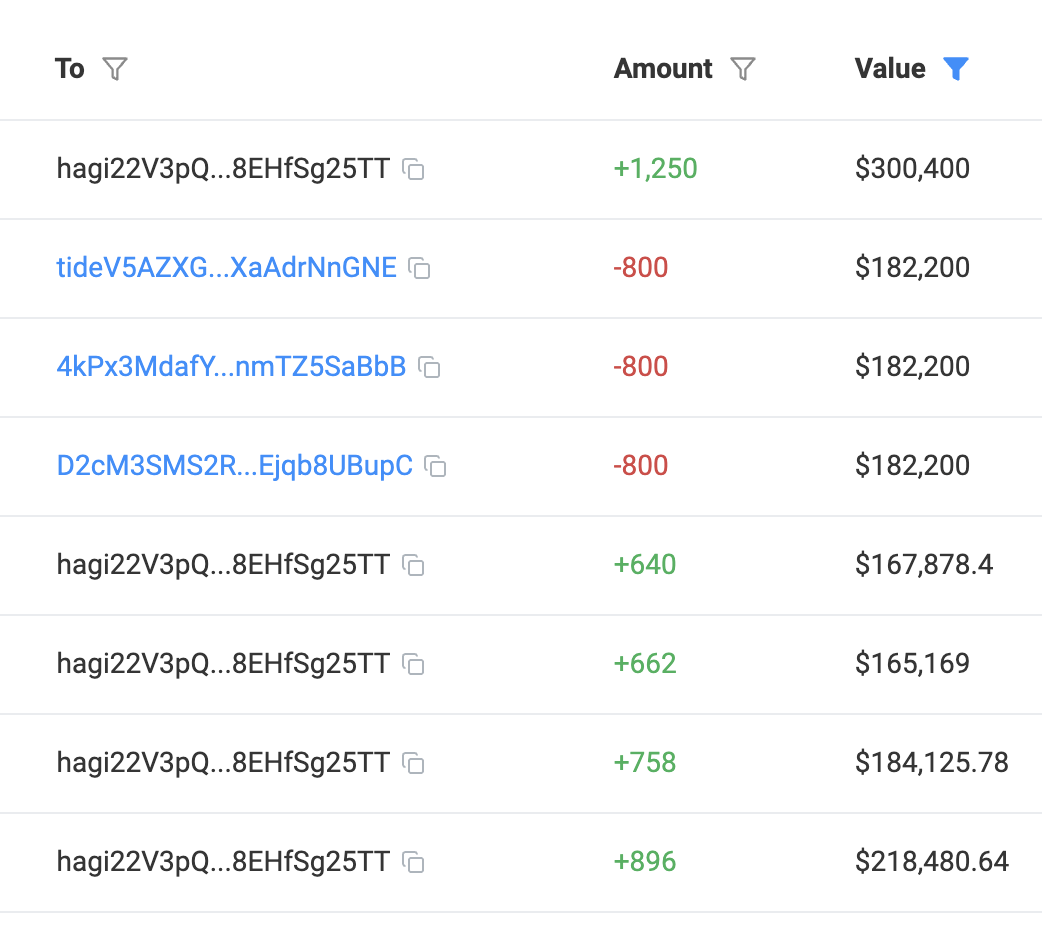

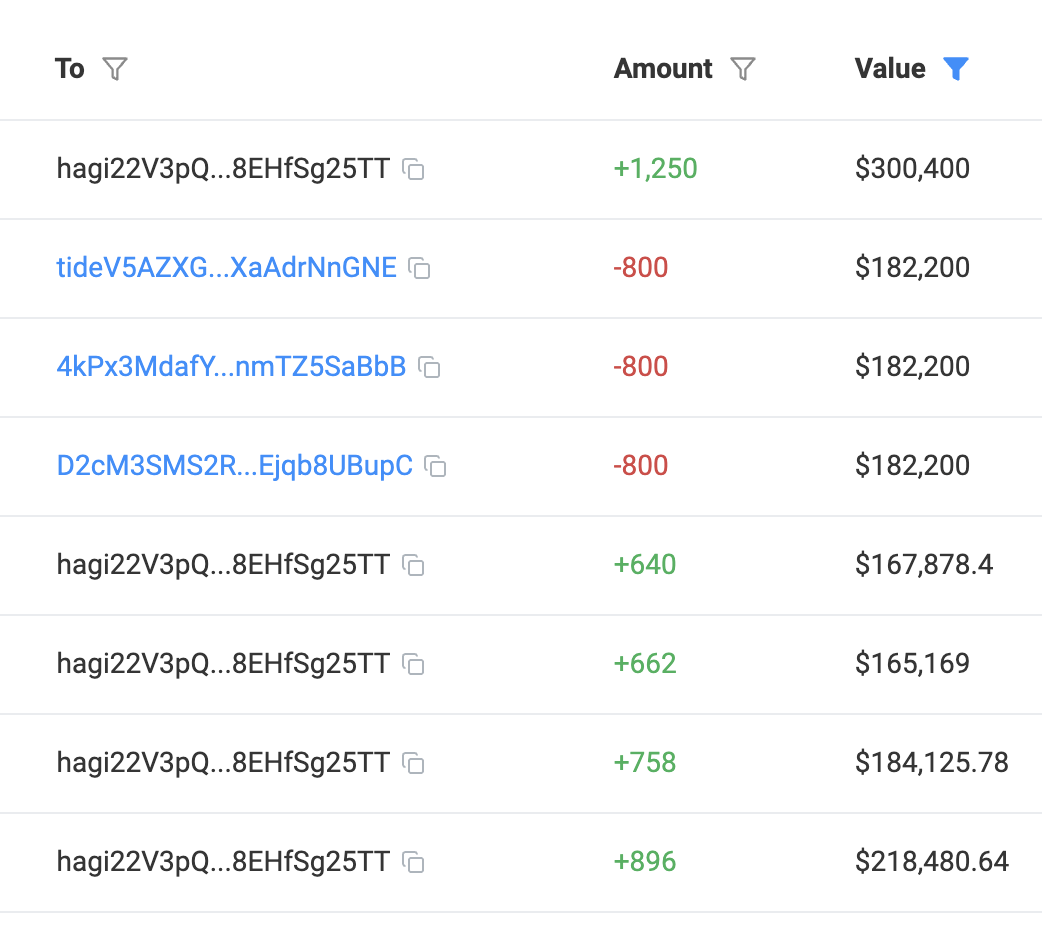

I know, it sounds ridiculous. Luckily, because blockchain is defined by proofs (and because I wanted to document my progress), it's all publicly verifiable onchain. Here are some of the account's transactions. *It still feels very weird filtering for >$150k.

I've been trading all my life and it's mostly culminated in this. At 14, I was introduced to blockchain and cryptocurrencies. I wanted to trade but I didn't have capital, let alone an edge. Below I've written how I got both. I think the most notable part of this is that I never traded shitcoins and exclusively traded Solana.

This isn't specific to me, but I think being contrarian helps a lot while trading. In micro, setting stop losses at less obvious price levels helps significantly in avoiding liquidation. In macro, I've found narratives online are almost always wrong; I've actually had the most success when I traded recreationally, unaware of public sentiment and paying no mind to influencers.

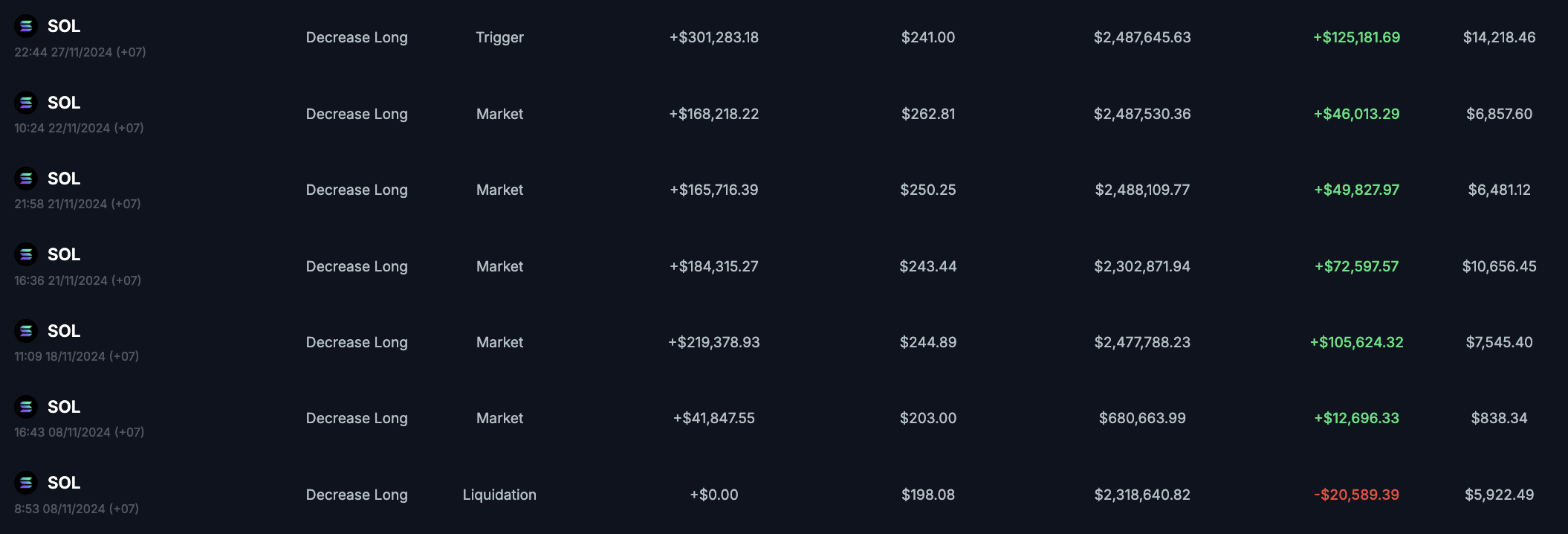

In essence, I tried to identify long-term(ish) price movement (e.g. 3 months), patiently and precisely bidding when prices retraced. According to both Claude and ChatGPT, my main strength was in squeezing out profit, but I think this was really intuitive. I dabbled in scalping but I found it ineffective given the time and energy. I also found exceptions in waiting for retraces, especially early in the cycle, where stepping on the gas was immensely profitable. All in all, there were tons of inefficiencies, most obviously losing 6 figures on Jupiter's fees, but also generally when I deviated from principle.

I've been trading in some form all my life. I've traded physical ddakji, virtual Pokemon, and tons of other MMORPG-related resources. The last game I seriously played was Albion. I enjoyed the competitive PvP part of it, but the game's main mechanic was death. You'd lose everything in your inventory after dying, kinda like hardcore Minecraft. To play competitively, you had to be rich.

I learned a lot about arbitrage by playing, and the same mechanics showed up later in crypto, though it was way more intuitive in Albion. I had refiners delivering me raw materials that I'd craft and send off to transporters. One of these refiners actually introduced me to crypto, leaving our monopoly of fire staves to play a crypto trading card game on Immutable. I obviously wanted in.

I've always been an F2P player, and as a 14 year old, I didn't really have any capital to start trading with. I dug around and found a community offering 1 SOL (around $100 at the time) in a meme-making competition. I won essentially by actively chatting with the moderators of the competition. I really benefited from this humanity in crypto, and I'm grateful I had the opportunity to start any of this.

I would spend the next few months of Year 10 (grade 9) turning my humble $100 portfolio into over $20K trading NFTs on Solana. This involved grinding whitelists, sniping new mints, and general flipping. I think a lot of the community at this time came from sneaker botting, and this was essentially the meta at the time. I do regret not taking a more balanced approach (with my health and studying), but admittedly, this simple-minded obsession felt easiest to me.

I faced tribulation every other day and maintained killer schedules. I probably had the worst possible timezone to do all this. I regularly woke up at 2-3 AM to catch drops, and I'd actually catch myself feeling happy when I got to wake up at 7. After wrecking my physical health and sanding down my dopamine receptors, I realized it was time to move on.

I wanted to become a developer and I figured an internship would be the best way forward. Massive thanks to Josh C. for helping me learn dev. I literally just asked about random stuff and we gradually became friends over time. I also really appreciate Carlos N. for introducing me to Mert at Helius. I don't think I could've found a better place to start at. I ended up making a viral tweet about Helius and landed the internship. It helped that I didn't need or care about the money, and it almost felt like being paid $500 a month to learn about developer infrastructure. I do wish I did more technical stuff here, but I guess considering I was too shy to turn on my camera at standup, I was given a reasonable level of trust.

I believe all these things contributed significantly to how I eventually made the million, and also how I lost it. Because I was deeply ingrained in the Solana community, I was sure Solana would thrive in a bull market. I also felt that learning to program lessened the impact of my portfolio's value on my self-worth, which perhaps made me more tolerant of risk. I thought (and maybe think) of money as no more than a number. I didn't really spend any of it. I simply found joy in winning trades and did it for fun.

Fast forward to the summer before grade 11, I'd concluded my gig at Helius and started anew at RevisionDojo. Crypto had a resurgence, and I started trading again. The resurgence stemmed from airdrops. I'd actually received an airdrop ($BONK) a year before that would eventually be worth >$1m, but I sold it for $600, so I guess this was my second time losing $1m. I didn't really benefit directly from these airdrops, but I did benefit a lot from the increase in ecosystem liquidity.

Trading felt pretty easy. I pretty casually grew ~$30k to $50k in a few days, then $50k to around $100k over the span of a few weeks.

This was around the time I created the wallet linked at the start of this post. I worked at Helius under the name Tidelaw, but I knew I wanted to own this journey regardless of its outcome, hence the vanity address.

Towards the end of this, I had tapped out the liquidity (around $2.5m) on leverage of the exchange I used, and I'd started resorting to opening multiple positions using different wallets. In hindsight, this would've been a good place to simmer. At the peak, I was making over $100k in profit on each trade, while rarely losing.

It's easy to prop up this part of the journey, but in reality, I was on a constant tightrope. I very rarely got liquidated because I almost always doubled down. Aside from the obvious risk, this meant I would spend tons in fees, often paying to keep on losing. This worked, largely thanks to the asymmetry of the bets and market conditions at this specific time.

I knew I couldn't really predict price action to a reasonable degree of accuracy, so I didn't try. I stuck to one direction (upwards) and waited patiently.

Did I get lucky? Maybe, at times. Obviously, though, there are many more people with starting conditions far more favorable that have never done as well. I think the most notable thing other than the scale is the nature of the trades (i.e., being ethical). The stigma behind crypto is unfortunate but true, and I personally haven't heard of anyone else trading from essentially nothing to over $1m without shoddy dealings, at least in my age range.

So, what'd I do with all this money? Well, until the end of 2024, I didn't do anything. I wasn't sure about the tax implications and figured saving wasn't so bad.

Eventually, I bought an iPad, a backpack, and three graphic tees. All in all, I spent less than 3/1000 or 0.3% of what I'd made.

Then, it all went away. It started as one bad trade. I really didn't think I was wrong, so I doubled down on it. I didn't just double down, though; I quadrupled down on four wallets and lost spectacularly. Ok, so I was down to around $400k. Unfortunately, my UC applications were a few days away, and I'd put my crypto portfolio in there as an extracurricular. I had listed a portfolio of around $500k, so I simply had to make back $100k.

Only, I'd never cared about the timing or the money before. As my portfolio kept shrinking, I cared less and less about just how much I was losing. The silver lining, I guess, was detangling my self-worth from this number.

In any case, I never really saw crypto (trading) as a means, let alone an end. I think I have a pretty unique disposition, shaped not just by handling these life-changing sums of money but also by similar circumstances. I'm confident I can do almost anything given time and effort, unswayed by the changing of tides. In time, this saga will be a footnote.

Edit 1: This is kind of like a Pythagorean cup. I had 5-6 figures for over a year before I overstepped and lost it all. In applying to fellowships and internships, I've had to justify my ability, potential, and uniqueness, and I hate that at the moment it boils down to this.